LoanBaazar is excel in offering Home Loan, Mortgage Loan, Business Loan, Personal Loan, Education Loan, Credit Cards, SME Working Capital Loan and Equipment Finance at the most competitive rates from all leading Banks and NBFCs.

In today’s financial landscape, a credit score is a crucial aspect of one’s financial health. A credit score, often referred to as a CIBIL score, is a numerical representation of an individual’s creditworthiness. It is used by lenders to assess the risk of lending money to borrowers. A high CIBIL score opens the doors to better loan terms, lower interest rates, and increased financial opportunities. Conversely, a low CIBIL score can lead to limited access to credit and higher interest rates. In this article, we will explore the factors that impact the CIBIL score and highlight their significance in maintaining a healthy financial profile.

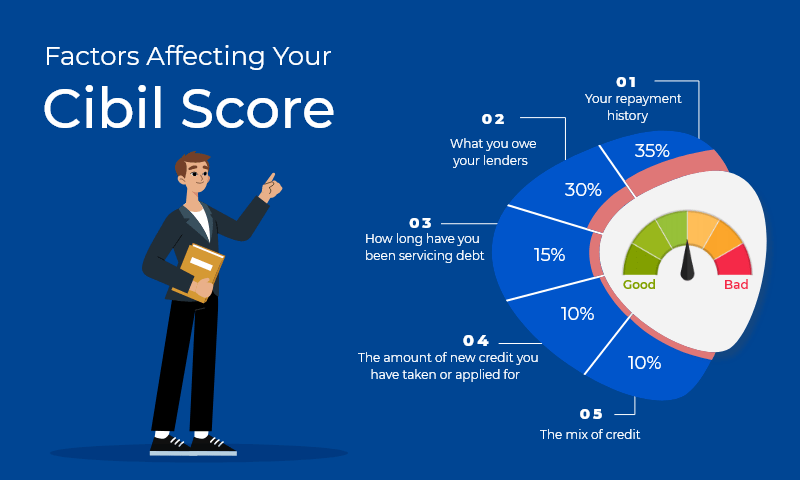

The most significant factor influencing your credit score is your payment history. This aspect reflects whether you have been responsible for making timely payments on your credit accounts, such as credit cards, loans, and mortgages. Any missed or late payments can have a substantial negative impact on your CIBIL score. Consistently paying bills on time is essential to maintaining a healthy CIBIL score.

Credit utilization refers to the percentage of available credit that you are currently using. It is calculated by dividing your outstanding credit balances by your total available credit limit. A high credit utilization ratio can indicate financial stress and increase the risk perception for lenders. Ideally, you should aim to keep your credit utilization below 30% to have a positive impact on your CIBIL score.

The length of your credit history is the duration for which you have been using credit. A longer credit history provides more data for lenders to assess your creditworthiness accurately. It is beneficial to maintain old credit accounts and avoid closing them, as it can positively impact your CIBIL score.

Credit mix refers to the various types of credit accounts you have, such as credit cards, instalment loans, and retail accounts. A healthy mix of credit demonstrates your ability to handle different types of credit responsibly. However, opening multiple credit accounts in a short period can negatively affect your CIBIL score.

When you apply for new credit, it triggers a hard inquiry on your credit report. Multiple hard inquiries within a short period can signal financial distress and lower your credit score. It is essential to be mindful of how often you apply for credit, especially if you plan to make significant financial decisions like buying a car or a house.

A good credit score is a valuable asset that can open doors to financial opportunities and provide you with a sense of financial security. Understanding the factors that impact your credit score is essential in maintaining a healthy financial profile. By paying bills on time, managing credit utilization, maintaining a diverse credit mix, and being cautious with new credit applications, you can steadily improve and preserve a high credit score.

It is crucial to regularly review your credit report to ensure its accuracy and identify any errors that may be affecting your score negatively. If you encounter any discrepancies, promptly report them to the credit bureaus for correction. Remember that building and maintaining a good credit score is a long-term process that requires financial discipline and responsibility.

In conclusion, a strong credit score empowers you to achieve your financial goals, access better loan terms, and secure a bright financial future. By understanding and managing the factors that impact your credit score, you can pave the way for a financially healthy and stable life.