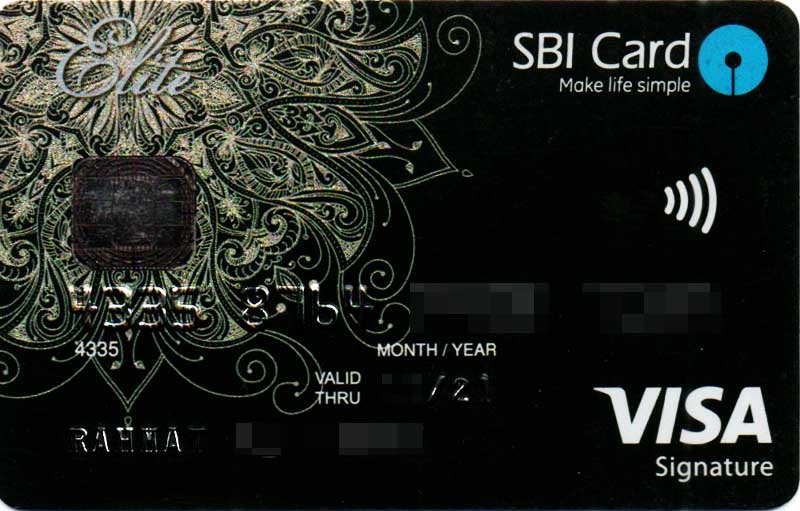

Top reasons to get the SBI Elite Credit Card

- The SBI Elite Credit Card is a premium credit card that comes with a host of features and benefits. Here are some of the key features of this credit card:

Welcome Bonus:

The SBI Elite Credit Card offers a welcome bonus of up to 20,000 reward points on payment of the joining fee.

Rewards Program:

Cardholders can earn reward points on every transaction made using the card. The reward points can be redeemed for a variety of options, including air miles, hotel stays, and merchandise.

Lounge Access:

The card offers complimentary access to select domestic and international airport lounges. Cardholders can enjoy up to 6 complimentary lounge visits per year.

Golf Privileges:

The SBI Elite Credit Card provides cardholders with access to select golf courses in India, along with complimentary green fee waiver and lessons.

Travel Benefits:

The card offers benefits such as travel insurance, free movie tickets, and discounts on hotel bookings.

Dining Benefits:

The SBI Elite Credit Card provides exclusive discounts and offers on dining, both in India and overseas.

Milestone Benefits:

Cardholders can earn additional rewards and benefits by reaching certain spending milestones on the card.

Contactless Payment:

The SBI Elite Credit Card supports contactless payments, allowing users to make quick and secure transactions without the need for a PIN or signature.

Fuel Surcharge Waiver:

Cardholders can enjoy a fuel surcharge waiver of up to Rs. 250 per statement cycle on fuel transactions.

Zero Liability:

The card offers zero liability on lost or stolen cards, provided the cardholder reports the loss immediately.

For further details, please Click here

The SBI Elite Credit Card is a premium credit card that comes with a range of privileges and benefits. Here are some of the key privileges offered by this credit card: